How To Invest In Stocks: The Intelligent Investor Strategy

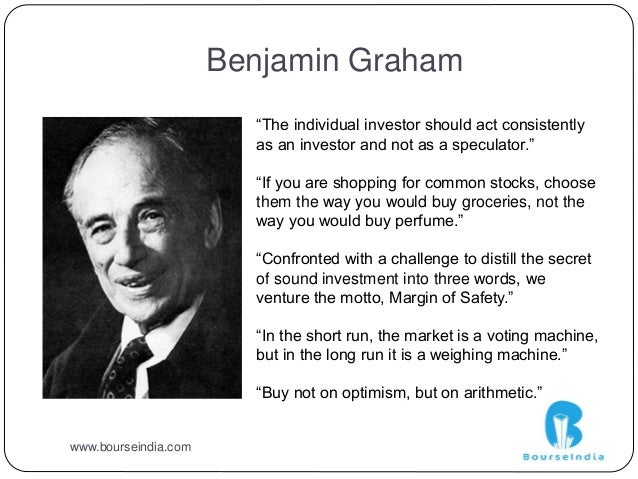

Introduction of Graham:-

Graham was a star student at Columbia University in New York, and went to work on Wall Street shortly after graduation in 1914. He built up a sizable personal nest egg over the next 15 years with the use of his keen attention to details. Even so, he hadn't yet honed his investment strategy.

Graham's Legacy

Graham's work is legendary in investment circles. He's been credited as the creator of the security analysis profession. While best known as Warren Buffett's mentor, Graham was also a famous author, most notably for his books "Security Analysis" (1934) and "The Intelligent Investor" (1949). Graham was one of the first to solely use financial analysis to successfully invest in stocks. He was also instrumental in drafting many elements of the Securities Act of 1933, also known as the "Truth in Securities Act," which, among other things, required companies to provide financial statements certified by independent accountants. This made Graham's work of financial analysis much easier and more efficient, and in this new paradigm, he succeeded.

Benjamin Graham[1] is far and away one of the biggest names in the history of investment strategizing. In his book The Intelligent Investor, he describes five strategies investors can use to maximize their success in the stock market. The key factors in determining which of Benjamin Graham investment strategies[2] to use are how much effort you are willing to put in and what you are hoping to get from your portfolio (higher returns or more stable growth).

Here we will take a look at the strategies he developed decades ago which are still being successfully used by many investors today.

Principle of Graham's:-

Principle #1: Always Invest with a Margin of Safety:-

Margin of safety is the principle of buying a security at a significant discount to its intrinsic value, which is thought to not only provide high-return opportunities, but also to minimize the downside risk of an investment. In simple terms, Graham's goal was to buy assets worth $1 for 50 cents. He did this very, very well.

To Graham, these business assets may have been valuable because of their stable earning power or simply because of their liquid cash value. It wasn't uncommon, for example, for Graham to invest in stocks where the liquid assets on the balance sheet (net of all debt) were worth more than the total market cap of the company (also known as "net nets" to Graham followers). This means that Graham was effectively buying businesses for nothing. While he had a number of other strategies, this was the typical investment strategy for Graham.

This concept is very important for investors to note, as value investing can provide substantial profits once the market inevitably re-evaluates the stock and ups its price to fair value. It also provides protection on the downside if things don't work out as planned and the business falters. The safety net of buying an underlying business for much less than it is worth was the central theme of Graham's success. When chosen carefully, Graham found that a further decline in these undervalued stocks occurred infrequently.

While many of Graham's students succeeded using their own strategies, they all shared the main idea of the "margin of safety."

Principle #2: Expect Volatility and Profit from It:-Investing in stocks means dealing with volatility. Instead of running for the exits during times of market stress, the smart investor greets downturns as chances to find great investments. Graham illustrated this with the analogy of "Mr. Market," the imaginary business partner of each and every investor. Mr. Market offers investors a daily price quote at which he would either buy an investor out or sell his share of the business. Sometimes, he will be excited about the prospects for the business and quote a high price. Other times, he is depressed about the business's prospects and quotes a low price.

Because the stock market has these same emotions, the lesson here is that you shouldn't let Mr. Market's views dictate your own emotions, or worse, lead you in your investment decisions. Instead, you should form your own estimates of the business's value based on a sound and rational examination of the facts. Furthermore, you should only buy when the price offered makes sense and sell when the price becomes too high. Put another way, the market will fluctuate, sometimes wildly, but rather than fearing volatility, use it to your advantage to get bargains in the market or to sell out when your holdings become way overvalued.

Here are two strategies that Graham suggested to help mitigate the negative effects of market volatility:

Dollar-Cost Averaging

Dollar-cost averaging is achieved by buying equal dollar amounts of investments at regular intervals. It takes advantage of dips in the price and means that an investor doesn't have to be concerned about buying his or her entire position at the top of the market. Dollar-cost averaging is ideal for passive investors and alleviates them of the responsibility of choosing when and at what price to buy their positions.

Dollar-cost averaging is achieved by buying equal dollar amounts of investments at regular intervals. It takes advantage of dips in the price and means that an investor doesn't have to be concerned about buying his or her entire position at the top of the market. Dollar-cost averaging is ideal for passive investors and alleviates them of the responsibility of choosing when and at what price to buy their positions.

Investing in Stocks and Bonds

Graham recommended distributing one's portfolio evenly between stocks and bonds as a way to preserve capital in market downturns while still achieving growth of capital through bond income. Remember, Graham's philosophy was first and foremost, to preserve capital, and then to try to make it grow. He suggested having 25% to 75% of your investments in bonds and varying this based on market conditions. This strategy had the added advantage of keeping investors from boredom, which leads to the temptation to participate in unprofitable trading (i.e. speculating).

Graham recommended distributing one's portfolio evenly between stocks and bonds as a way to preserve capital in market downturns while still achieving growth of capital through bond income. Remember, Graham's philosophy was first and foremost, to preserve capital, and then to try to make it grow. He suggested having 25% to 75% of your investments in bonds and varying this based on market conditions. This strategy had the added advantage of keeping investors from boredom, which leads to the temptation to participate in unprofitable trading (i.e. speculating).

Principle #3: Know What Kind of Investor You Are

Graham advised that investors know their investment selves. To illustrate this, he made clear distinctions among various groups operating in the stock market.

Graham advised that investors know their investment selves. To illustrate this, he made clear distinctions among various groups operating in the stock market.

Active vs. Passive

Graham referred to active and passive investors as "enterprising investors" and "defensive investors."

Graham referred to active and passive investors as "enterprising investors" and "defensive investors."

You only have two real choices: the first choice is to make a serious commitment in time and energy to become a good investor who equates the quality and amount of hands-on research with the expected return. If this isn't your cup of tea, then be content to get a passive (possibly lower) return, but with much less time and work. Graham turned the academic notion of "risk = return" on its head. For him, "work = return." The more work you put into your investments, the higher your return should be.

If you have neither the time nor the inclination to do quality research on your investments, then investing in an index is a good alternative. Graham said that the defensive investor could get an average return by simply buying the 30 stocks of the Dow Jones Industrial Average in equal amounts. Both Graham and Buffet said that getting even an average return, such as the return of the S&P 500, is more of an accomplishment than it might seem. The fallacy that many people buy into, according to Graham, is that if it's so easy to get an average return with little or no work (through indexing), then just a little more work should yield a slightly higher return. The reality is that most people who try this end up doing much worse than average.

In modern terms, the defensive investor would be an investor in index funds of both stocks and bonds. In essence, they own the entire market, benefiting from the areas that perform the best without trying to predict those areas ahead of time. In doing so, an investor is virtually guaranteed the market's return and avoids doing worse than average by just letting the stock market's overall results dictate long-term returns. According to Graham, beating the market is much easier said than done, and many investors still find they don't beat the market.

Speculator vs. Investor

Not all people in the stock market are investors. Graham believed that it was critical for people to determine whether they were investors or speculators. The difference is simple: an investor looks at a stock as part of a business and the stockholder as the owner of the business, while the speculator views himself as playing with expensive pieces of paper, with no intrinsic value. For the speculator, value is only determined by what someone will pay for the asset. To paraphrase Graham, there is intelligent speculating as well as intelligent investing; the key is to be sure you understand which you are good at.

Not all people in the stock market are investors. Graham believed that it was critical for people to determine whether they were investors or speculators. The difference is simple: an investor looks at a stock as part of a business and the stockholder as the owner of the business, while the speculator views himself as playing with expensive pieces of paper, with no intrinsic value. For the speculator, value is only determined by what someone will pay for the asset. To paraphrase Graham, there is intelligent speculating as well as intelligent investing; the key is to be sure you understand which you are good at.

Strategy One:-

This strategy requires the least amount of effort and creates a portfolio of defensive stocks. It is based on Graham’s assertion that mutual funds did no better than the market average when compared to the indices. By that logic, it is better to invest in index funds which can be found in a popular index like S&P 500 (Standard & Poor’s 500) or DIJA (Dow Jones Industrial Average).

It requires so little effort because, according to Graham, which index funds you specifically choose makes little difference.

Strategy Two:-

This is another strategy for building a defensive portfolio, however, it requires a little more effort than the first on the part of the investor. This strategy outlines a set of strict criteria which a stock must meet in order to be considered a defensive grade stock. That is, a well-established and financially strong stock which will have relatively low risk.

The criteria are as follows:

- The company must generate a minimum of $500 million in sales.[1]

- The company’s current assets should be at least twice the amount of its current liabilities.

- The long-term debt that the company has should not exceed its net current assets.

- The company should have some earnings for the common stock each year for the past 10 consecutive years.

- The company should have a record of continuous payment on its dividends for at least 20 years.

- A minimum increase of at least one third should be evident in its per share earnings over the past 10 years.

- The current price of the stock should not be more than 15 times the company’s average earnings.

- The current price also should not be more than 1.5 times the book value.

In addition to these criteria, Graham developed a formula for calculating the ideal price of a defensive grade stock. The formula (the output of which is commonly known as the Graham Number) is as follows:

In this equation, EPS refers to the company’s earnings per share and BVPS is the book value of equity per share. Both of these figures can be found in the company’s financial records.

For this strategy, it is recommended to have a portfolio of 10 to 30 stocks. However, because the companies which meet all of the criteria are limited to the larger, well-established ones, it requires little effort beyond the initial selection of stocks.

Strategy Three:-

Unlike the previous two strategies, this one is geared toward the riskier value stocks. It also requires more diligence in making investments and tracking them to ensure you get your desired returns. In this strategy, Graham outlines the criteria for selecting enterprising grade stocks.

In order to be considered a relatively safe enterprising stock, the company must fulfill these requirements:

- The current assets must be at least 1.5 times the current liabilities.

- The amount of debt cannot exceed 110% of the current net assets.

- It must show evidence of earnings stability; meaning there should be no deficit reporter in the last five years.

- The company must also have a record of dividend payments. Because enterprising stocks are necessarily less established, it does not have to be as strong as with a defensive stock. However, there must be some current dividend.

- It must also show signs of growth in earnings. This criterion is fulfilled if the previous year’s earnings are higher than its earnings five years prior.

- The price of the stock must be less than 120% of the net tangible assets

Because enterprising grade stocks are less established, investors should have a more diversified portfolio of at least 20 stocks. This type of portfolio also requires more careful selection, verification and regular tracking and balancing.

Strategy Four:-

This one requires the maximum amount of effort from the investor because it involves the most high risk stocks: NCAV (Net Current Asset Value) grade stocks. These are typically smaller, emerging companies that show a lot of potential but do not yet have an extensive record to ensure profitability.

Graham advises that in selecting NCAV stocks, investors should immediately eliminate any stocks which have reported net losses at any point in the past year. Furthermore, the price of the stock should be lower than the company’s net current assets. Due to the high risk of these stocks, it is recommended to have a very diversified portfolio of at least 30 stocks.

Strategy Five:-

Graham’s fifth strategy is much less concrete than the previous four and is not recommended for most investors as it requires an extremely high level of effort and is very risky. This is due to the fact that it is not a strategy based on quantifiable factors like financial records or market trends.

Instead, this strategy requires investors to look at special situations such as acquisitions of smaller companies by larger ones, breakup of holding companies, arbitrage operations, and companies involved in complicated legal proceedings so that prices are uncharacteristically low. Essentially, this strategy looks at the company’s current situation rather than simply its finances to predict the future success or decline of its stock.

This strategy should be used in conjunction with one of the other strategies since on their own these special situations are too speculative to be useful predictors of future results. This combined use with other strategies is also advisable because investors looking to use this one should already be quite familiar with the other four before attempting something so complicated and high-risk.

Creating a balanced portfolio:

Another great option for investors is to use two or three of these strategies in order to create a balanced portfolio which contains defensive stocks as well as the riskier enterprising and NCAV stocks. With such a portfolio, you will be able to have the security of defensive stocks along with the higher returns of the enterprising grade stocks.

Note:- In Benjamin Graham’s original set of criteria he specifies $100 million. This figure adjust for the inflation since he wrote in 1973.

Comments

Post a Comment